Strategic Transactions (M&A)

In an increasingly competitive and fast-changing environment, small and mid-sized companies need more than isolated solutions — they need an integrated vision that connects strategy, finance, and execution.

Gaelica Finance was created with this purpose: to stand by the entrepreneur with a practical, personalized, and results-oriented approach from planning through value realization.

Contact Our M&A TeamYour Challenges

Common questions our clients face when approaching strategic transactions

How do I build an effective Day 1 action plan?

How can I negotiate at the right time and close the best deal possible?

How do I ensure that the value created over the years is fully captured?

What are the smartest paths to sell, grow, or attract investment and maximize value for shareholders?

Is my company ready for a transaction? What is missing?

Why Gaelica?

Over 20 years of experience in M&A and Valuation

Advisory track record with major banks, funds, and global investors

Use of AI-driven tools in corporate finance

2,000+ company valuations completed

A blend of deep expertise, strategic vision, and agility

Sectors we serve:

Family businesses, startups, entrepreneurs

Healthcare, pharmaceuticals, biotech

Banks, asset managers, funds

Consumer & retail

Industry & services

Agribusiness and energy

Technology, software, digital media

Our Transaction Services

Pre-Transaction Strategy

- Market and competitive landscape analysis

- Growth and monetization strategy design

- Risk assessment and investment alternatives

- Structuring transaction feasibility

Deal Execution

- Technical valuation and value defense

- Investor engagement and qualification

- End-to-end process management

- Support on due diligence and legal/tax structuring

- SPA and closing strategy

Deal Closing

- Negotiation of due diligence findings

- Drafting of LOIs and binding offers

- Final SPA structuring with strategic oversight

Post-Transaction

- Integration and transition plan execution

- 100-day post-closing plan with active management

- Value creation initiatives and strategic transformation

Our M&A Approach

Sell-Side Flow

- 1Strategic understanding

- 2Value diagnosis and benchmarking

- 3Investor mapping and selection

- 4Teaser + NDA → Info Memo and Process Letter

- 5Q&A and Non-Binding Offers (NBO)

- 6Due diligence and exclusivity

- 7Final negotiation and SPA

Buy-Side Flow

- 1Strategic alignment

- 2Target mapping

- 3Value analysis and benchmarking

- 4Document request and NDA

- 5Negotiation and exclusivity

- 6Final SPA negotiation and closing

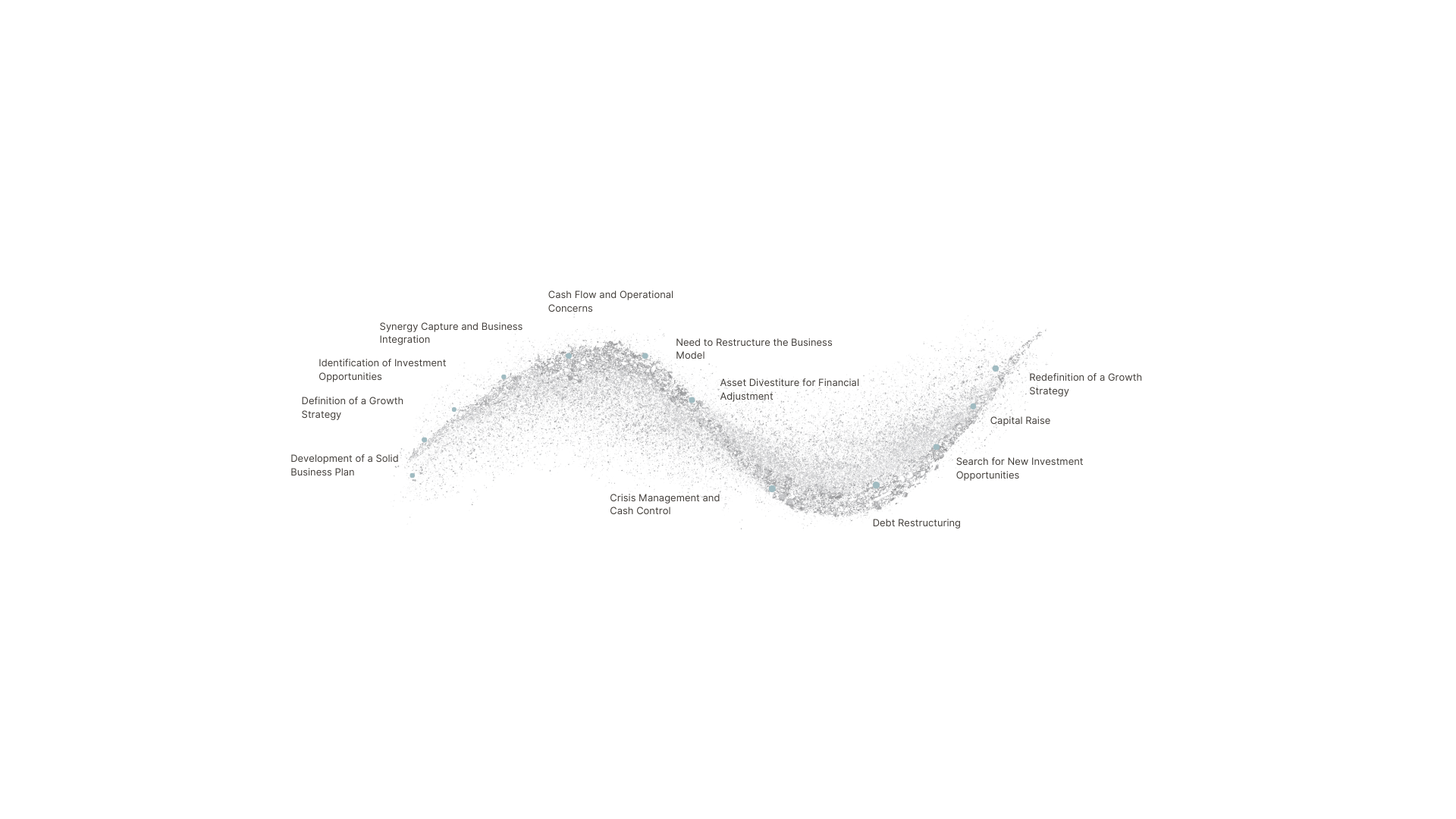

Regression Cyclical Strategic Business Decision Flow

Our approach adapts to your position in the business cycle, providing tailored strategies for each phase

Market Cycle & Strategic Timing

Growth

Expansion phase with elevated valuations and high market activity

Maturity

Plateau phase with stabilizing valuations and selective transactions

Decline

Declining phase with pressure on multiples and increased selectivity

Recession

Correction phase with acquisition opportunities for prepared buyers

Valuation Methods We Apply

Discounted Cash Flow (DCF)

Based on projected free cash flows

Net Asset Value

Adjusted book value of assets and liabilities

We use the combination of methods that best fits the company's profile and the objective of the valuation — whether for a sale, fundraising, shareholder entry, or strategic decision.

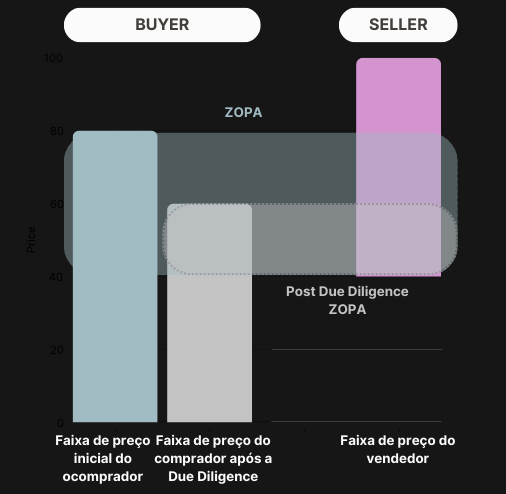

ZOPA & BATNA: Maximizing Deal Value

ZOPA (Zone of Potential Agreement): the real space for negotiation

BATNA (Best Alternative to a Negotiated Agreement): the fallback strategy to strengthen your position

Deal mechanisms to unlock or expand ZOPA:

- Earn-out: aligns future performance with price

- Vendor Due Diligence: builds confidence and reduces discounts

- Reps & Warranties: risk allocation mechanisms

- Holdback, Escrow, MAC Clauses: mitigate uncertainty and improve terms

Contact Our M&A Team

Gabriel C Carracedo

Partner, Gaelica Finance

📞 +55 (11) 99916-8448

📧 gcarracedo@gaelicafinance.com

🌐 www.gaelicafinance.com